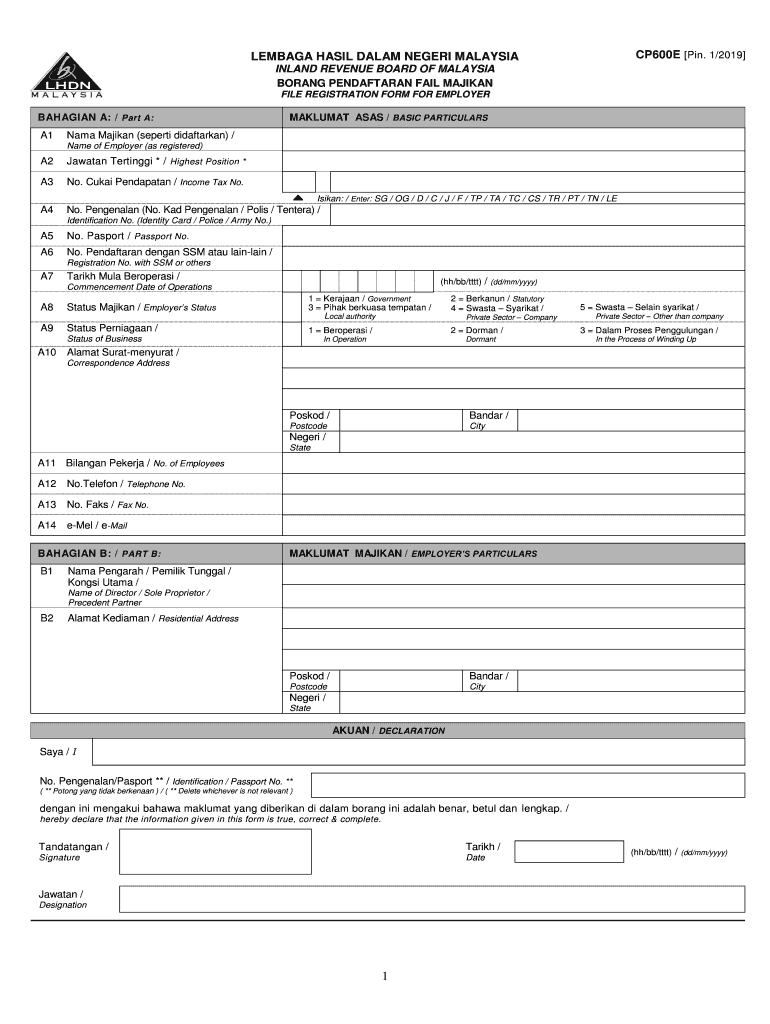

Form e borang e is a form that an employer must complete and submit to the internal revenue board of malaysia ibrm or lembaga hasil dalam negeri lhdn. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

Borang Fill Online Printable Fillable Blank Pdffiller

Complete fillable Borang E Filing Lhdn Form 2011-2022 with signNow in minutes.

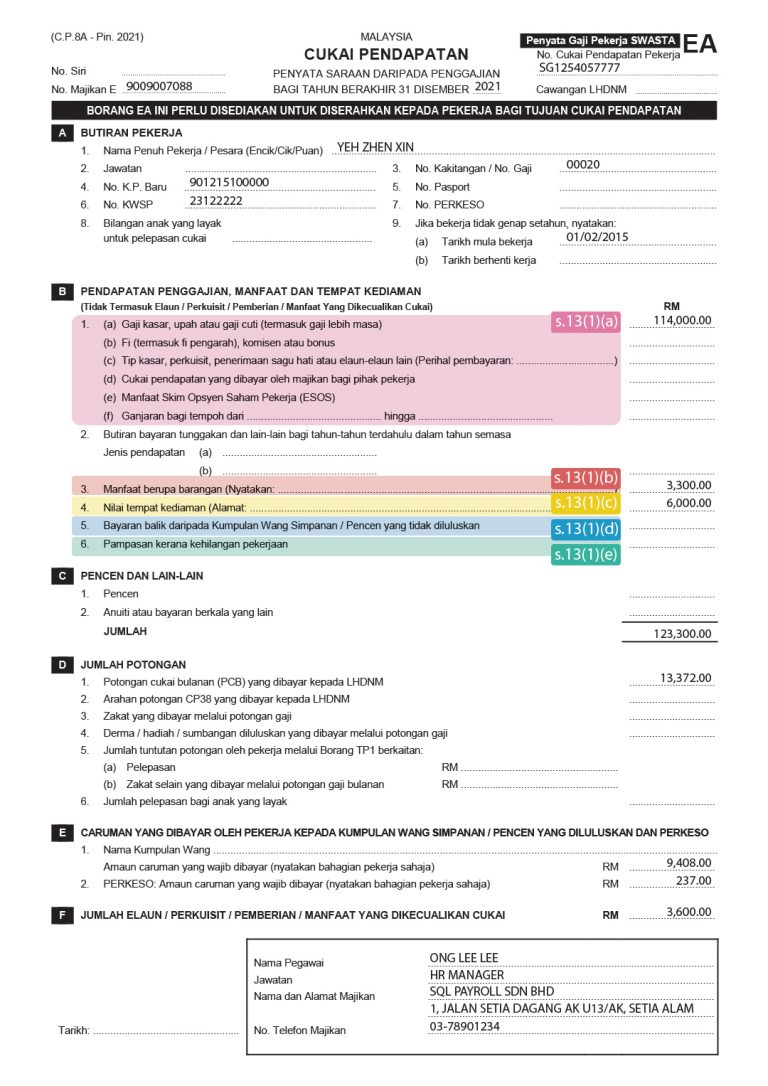

. EA Form in PDF Download. Section 83 1A Income Tax Act 1967. Tarikh akhir pengemukaan Borang BE Tahun Taksiran 2021 adalah 30 April 2022.

Guide notes for forms ea ec Pdf format download opens in new window word format download opens in new window excel format. B Kegagalan mengemukakan Borang E pada atau sebelum 31 Mac 2020 adalah menjadi satu kesalahan di bawah. Ea Form 2020 2019 And E Form Cp8d Guide And Download.

Aplikasi e-Filing adalah merupakan sistem yang membolehkan pembayar cukai membuat pengisian dan menghantar Borang Nyata Cukai Pendapatan BNCP dan borang anggaran secara dalam talian. RETURN OF REMUNERATION FROM EMPLOYMENT CLAIM FOR DEDUCTION AND PARTICULARS OF TAX DEDUCTION UNDER THE INCOME TAX RULES DEDUCTION. The Borang E must be submitted by the 31st of march of every year.

As an employer this will be your responsibility to ensure that the rest of your employees get their forms by the month of February every year. Basically it is a tax return form informing the irb lhdn of the list of employee income information and number of employees it must be. 2019 BE Borang Nama.

Ad Download or Email MY CP39 More Fillable Forms Register and Subscribe Now. Jika pembayar cukai mengemukakan Borang e-BE Tahun Taksiran 2021 pada 16 Mei 2022 BN tersebut akan dianggap sebagai lewat diterima mulai 1 Mei 2022 dan. According to the Inland Revenue Board of Malaysia an EA form Malaysia also refer to Borang EA EA Statement EA Employee is an Annual Remuneration Statement that every employer shall prepare and render to his employee statement of remuneration of that employee before 1st March in the year immediately following the first mentioned year.

How to submit form e online. 2019 B LEMBAGA HASIL DALAM NEGERI MALAYSIA RETURN FORM OF AN INDIVIDUAL RESIDENT WHO CARRIES ON BUSINESS. Due date to furnish Form E for the Year of Remuneration 2019 is 31 March 2020.

4 a Employers which are companies and Labuan companies Companies -The use of e filing e E is mandatory. 03-89111000 603-89111100 Overseas FORM E 2019. Borang E contains information like the company particulars and details of every employees earnings in the company.

Easy Fast Secure. Sole proprietor need. 03-89111000 603-89111100 Luar Negara TAHUN TAKSIRAN 2019 CP2D - Pin.

Explore the easiest way to report your miscellaneous compensations. Due date to furnish Form E for the Year of. Failure to submit the Form E on or before 31 March 2020 is a criminal offense and can be prosecuted in court.

Grace period is given until 15 May 2019 for the e-Filing of Form BE Form e-BE for Year of Assessment 2018. LHDN Borang EA EA Form Malaysia According to the Inland Revenue Board of Malaysia an EA form Malaysia also refer to Borang EA EA Statement EA Employee is. The earnings that are to be included in CP8D form should be shown in.

Form E is an employee income declaration report that employers have to submit every year. Form e 2019 due date. 2019 P BorangLEMBAGA HASIL DALAM NEGERI MALAYSIA BORANG NYATA PERKONGSIAN.

Employers with their own computerised system and many employees are encouraged to prepare CP8D data in the. Please access via httpsezhasilgovmy. Form e submission deadline 2020.

159348 Form E Borang E is required to be submitted by every employer companyenterprisepartnership to LHDN Inland Revenue Board IRB every year not later than 31 March. For further information please contact Hasil Care Line-Hotline. BNCP dan borang anggaran yang disediakan dalam e-Filing adalah seperti berikut.

03-89111000 603-89111100 Overseas 2019 YEAR OF ASSESSMENTForm Amend. The latest version of the ea form for 2021 is. Majikan yang aklumat melalui e-Data Praisi tidak perlu mengemukakan Borang CP8D.

Failure to submit the Form E on or before 31 March 2020 is a criminal. Form e submission deadline 2019. Borang E contains information like the company particulars and details of every employees earnings in the company.

Pengenalan pasport. Ad Do Your 2020 2019 2018 2017 Taxes in Mins Past Tax Free to Try. Majikan yang aklumat melalui e-Data Praisi tidak perlu mengemukakan Borang CP8D.

EA Form in Excel Download. Contoh borang ea lhdn. Ada Punca Pendapatan PerniagaanPekerja Berpengetahuan atau Berkepakaran.

Potong yang tidak berkenaan No. 5 Untuk maklumat lanjut sila hubungi Hasil Care Line- Talian Hotline. Download pdf excel files and guides for ea form e form and cp8d in malay and english.

Ea form 2020 2019 and e form cp8d guide and download. 31 Mac 2020 a Borang E hanya akan dianggap lengkap jika CP8D dikemukakan pada atau sebelum 31 Mac 2020. Makluman boleh dibuat melalui e-Kemaskini atau dengan menggunakan Borang CP600B Borang Pemberitahuan Pertukaran Alamat yang boleh diperoleh di Portal Rasmi LHDNM.

03-89111000 603-89111100 Luar Negara 2019 TAKSIRAN CP3 - Pin. 7 The use of e-Filing e-B is encouraged. 5 For further information please contact Hasil Care Line-Hotline.

Please access via httpsezhasilgovmy. Borang E Filing Lhdn Form 2011-2022. Due date to furnish Form E for the Year of Remuneration 2019 is 31 March 2020.

Pendapatan Berkanun Jumlah Pendapatan Dan Pendapatan Tahun Kebelakangan Yang Belum Dilaporkan. B Employers other than Companies - The use of e-filing is encouraged. 1 Tarikh akhir pengemukaan borang.

03-8911 1000 Dalam Negara 603-8911 1100 Luar Negara. 4 Penggunaan e-Filing e-P adalah digalakkan.

Understanding Lhdn Form Ea Form E And Form Cp8d

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

2019 2022 Form My Cp600e Fill Online Printable Fillable Blank Pdffiller

Fillable Online Borang Vibraltar Form Fax Email Print Pdffiller

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

How To Get An Ea Form What Is Ea Form Is Ea Form Compulsory

Income Tax Form Ea 4 Why Income Tax Form Ea 4 Had Been So Otosection

2022 年大马报税需知 纳税人税率 Kadar Cukai 及如何计算税金

Income Tax Form Ea 4 Why Income Tax Form Ea 4 Had Been So Otosection

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

Borang E Archives Tax Updates Budget Business News

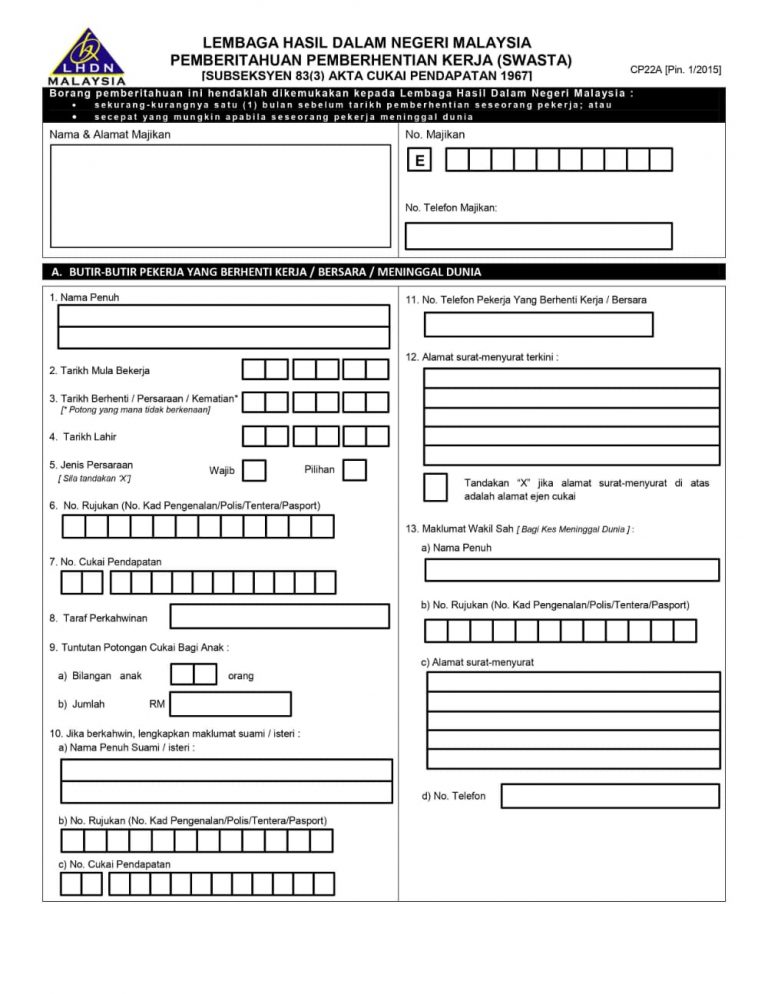

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

Here S A How To Guide File Your Income Tax Online Lhdn In Otosection

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

Income Tax Form Ea 4 Why Income Tax Form Ea 4 Had Been So Otosection